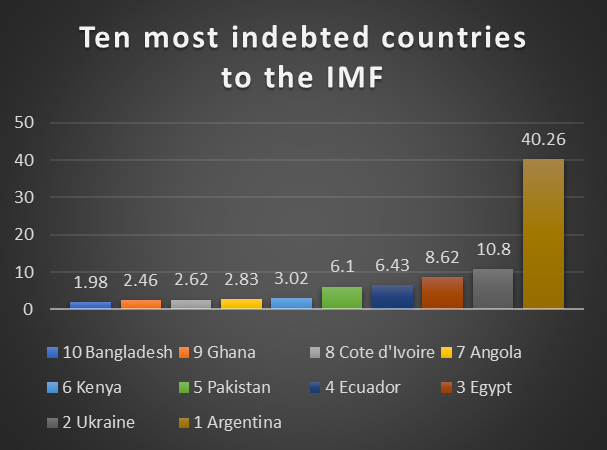

A review of the International Monetary Fund (IMF) recent debt profile reveals that 70% of the total of $117.6 billion in outstanding debt obligation is owed by the top ten countries. The report reveals that 91 countries have outstanding debt obligations to the IMF as of 8th May, 2025.

According to the report, the cumulative outstanding debt obligation of the top ten most indebted countries to the Fund totalled $82.44 billion.

The majority of countries featured were from low and emerging-market, mostly domiciled in Africa, South America, the Caribbean, and Asia. Less than 10 countries owing outstanding balances to the IMF were from Europe, and no G20 country had any balance with the Fund.

Of the top ten countries most indebted to the International Monetary Fund (IMF), five are from Africa, two from South America, two from Asia, and one from Europe, war-torn Ukraine.

Source: IMF

10. Bangladesh ($1.98 billion)

In 2024, Bangladesh reached a staff-level agreement with the IMF where the fund agreed to provide $645 million comprising Standard Drawing Rights (SDR 325.2 million (about US$426 million) under the External Credit Facility (ECF) and External Fund Facility (EFF) and SDR 166.7 million (about US$219 million) under the Resilient and Sustainability Facility (RSF).

Since 2020, the IMF has reached an agreement on support facilities totaling $4 billion but has only drawn around $355 million. In May 2020, the country reached a Rapid Financing Instrument (RCF) of $355.5 million.

Fast forward to January 2023, it agreed to three facilities with the IMF: an Extended Credit Facility (ECF) of $822 million, an Extended Credit Fund (ECF) of $1.6 billion, and a Resilience and Sustainability Facility (RSF) of $1 billion. All three facilities are yet to be drawn and are expected to expire by July 2026.

09. Ghana ($2.46 billion)

This West African country has outstanding debt balances with the IMF totaling $2.46 billion. Since defaulting on its debt obligation in 2022, Ghana has borrowed up to $1.17 billion from the IMF under the Extended Credit Facility (ECF) initiative.

However, the country’s economy has been in turmoil since the COVID-19 pandemic, with inflation reaching over 50% in 2022. In April 2020, the country agreed $738 million which it has drawn but not repaid.

The oldest unpaid IMF credit facility to Ghana dates back to 2015- an Extended Credit Facility (ECF) of $664.2 million, of which $393.5 million remains as an outstanding balance.

08. Côte d’Ivoire ($2.62 billion)

This country has outstanding balances with the IMF for credit facilities dating back to a decade ago in 2011. The country has drawn portions of its last three credit facilities from the IMF, which include: an $867.2 million ECF of 2023, a $1.73 billion ECF, and $975.6 million RSF of March 2024. All three are billed to expire by 23rd September, 2026.

07. Angola ($2.83 billion)

This oil-dependent economy has outstanding balances with the IMF to the tune of $2.83 billion, which was a $3.2 billion Extended Fund Facility (EFF) approved in December 2018 and set to expire in December 2021.

Beyond the high outstanding debt to the IMF, the country continues to be weighed down by extreme poverty, a high debt-to-GDP ratio, low life expectancy, high infant mortality, and epidemic corruption levels.

The situation appears gloomy for Angola in the coming years as the number of people living in the country is expected to climb to 16.3 million people.

06. Kenya ($3.02 billion)

The country’s total outstanding obligation to the IMF came under four credit facility programs: Rapid Credit Facility, Extended Fund Facility, Extended Credit Facility, and Resilience and Sustainability.

It has an outstanding balance of $542.8 million under the (RCF), and $1.51 billion under the EFF—the loan initially totaled $1.8 billion.

The country’s economy has been resilient despite the harsh operating environment in the past years, especially debt. Efforts by the Ruto-led government to raise revenue in line with recommendations of the Fund were met with the most brutal protests in the region to date.

05. Pakistan ($6.10 billion)

This country has received over $10 billion in credit facilities from the IMF since 2019. The latest of these facilities was the Extended Fund Facility of $5.32 billion, agreed in September 2024 and set to expire in 2027. Others include a $2.25 billion iStandby Agreement, which has been fully drawn by Pakistan, and EFF of $4.98 billion, of which $3.03 billion has been drawn.

Last week, the IMF’s Board completed its first review of the 37-month EFF and noted that the government’s effort under the EFF has delivered economic stability in terms of surplus, inflation reduction, and increase in the country’s gross external reserve.

The IMF Board, in its review of the country’s performance, further approved a request to access the $1.4 billion Resilience and Sustainability Facility (RSF), which aims to strengthen resilience to natural disasters and federal and provincial responses to natural disasters, among others.

04. Ecuador ($6.43 billion)

Aside from Argentina, Ecuador is the only South American country on the list. The latest of the IMF’s facilities comes amidst a significant fiscal deficit in the country, financial and fiscal instability, coupled with illiquidity problems.

In May 2024, the Board of the Fund approved a 48-month Extended Fund Facility (EFF) for Ecuador of $4 billion, of which $1 billion was immediately disbursed. This follows a September 2020 EFF of $4.61 billion, which has been completely drawn. Another Rapid Financing Instrument of $461.7 million was approved by the Fund in May of 2020, which was geared to help the country meet immediate balance of payment obligations in light of the shocks necessitated by the COVID-19 pandemic.

03. Egypt ($8.62 billion)

The economy of Egypt faced severe challenges in 2023 and 2024, necessitating the IMF to approve significant EFF. Among these challenges are disruption of trade through the Suez Canal owing to violence orchestrated by Yemeni Houthis in the Red Sea, significant refugee inflow from the war in Sudan and Gaza. Egypt’s economy faced significant economic shocks and pressures in 2023 and 2024 owing to insecurity, which disrupted trade volume in the Suez Canal and tourism, a vital source of forex for Egypt.

Beyond that, reforms in the foreign exchange market executed by the administration of President Sisi further encouraged support financing from the IMF. The Fund noted that these reforms are already bearing fruit for the country’s fiscal position.

02. Ukraine ($10.8 billion)

This country’s presence on the list should not surprise anybody, as the reason is obvious. In the last three years, Ukraine has engaged in a war with Russia, which has defied every move to resolve it.

Since Russia’s invasion of Ukraine in February 2022, the country has agreed to up to $12.6 billion in Rapid Finance Instrument and Extended Fund Facility with the IMF. However, the Fund has only been able to disburse around $9.6 billion.

01. Argentina ($40.26 billion)

Argentina topped the list of most indebted countries to the IMF due to the stabilization policies of the President Javier Milei administration, which inherited an economy on the brink of a balance of payments crisis.

In the past few years, no country has received more monetary support from the IMF than Argentina. Argentina’s economy prior to President Milei had already crashed—inflation reached 211%, but has declined, significant budget deficits, and a rapidly declining foreign exchange reserve meant that only an economic surgery could see the country through.

Last month, the IMF reached a staff-level agreement with Argentina, which could see the country receive up to $20 billion in credit facilities-—a further boost if eventually approved by the board. This is aside from the country’s $40 billion outstanding payment.

You must be logged in to post a comment.