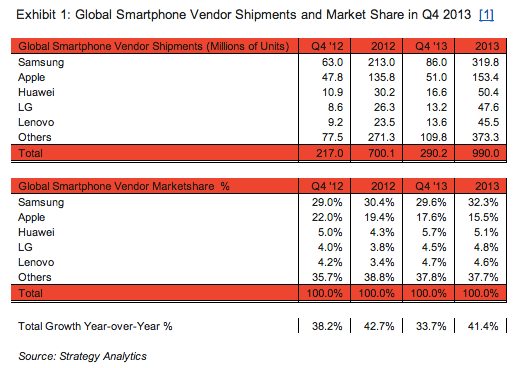

Techcrunch – To coincide with Apple releasing its Q1 earnings, Strategy Analytics has put out its quarterly and full-year figures for how the smartphone market has fared, along with figures on the wider mobile phone market. Overall, there were nearly 1 billion — 990 million — smartphones shipped in 2013, representing growth of 41% over 2012′s 700 million units. Smartphone shipments for the last quarter of 2013 were 290.2 million, up 34%.

Mobile phone shipments, meanwhile, were just under 1.7 billion — and as a mark of how smartphones are where all the buying has shifted, the wider mobile phone market grew only 5% over a year ago.

While 41% growth sounds good, Ken Hyers, an analyst at Strategy Analytics, notes that it is actually down slightly on the 43% growth of a year ago. He says this is because of “high penetration in some major markets like the United States.” This was something that had a direct effect on Apple. Traditionally a strong player in the U.S., CEO Tim Cook noted today that Apple’s sales in North America declined.

As we pointed out earlier today, although Samsung continues to remain in the lead with its 32% of all smartphone shipments, the real story appears to be about what is happening underneath that.

Apple continues to fall (pardon the pun) and is now at 15.5% for the full year (compared to 19% a year ago) on 153 million units. And although Huawei, LG and Lenovo are all behind Apple, together they are nearly overtaking the iPhone maker in units, with a combined share of 14.6%.

That’s not to overlook that Samsung’s growth is nothing short of impressive: its 319.8 million smartphones shipped in 2013 was the “largest number of units ever shipped by a smartphone vendor in a single year,” according to the analyst group’s executive director Neil Mawston. Samsung also retained its title as the world’s biggest mobile phone maker overall: it shipped 451 million units for a 27% share of the market.

Although Apple made a point today of talking up its emerging market business, Strategy Analytics (and perhaps others, given the stock decline) are not buying it: “Apple remains strong in the high-end smartphone segment, but a lack of presence in the low-end category is costing it lost volumes in fast-growing emerging markets such as India,” writes Mawston.

As in quarters past, the Samsung/Apple juggernaut is all but dominating the smartphone world in terms of vendors.

“Large marketing budgets, extensive distribution channels and attractive product portfolios have enabled Samsung and Apple to maintain their grip on the smartphone industry,” writes analyst Linda Sui.

The question will be whether the economics of making cheaper phones will mean that the smaller vendors like LG, Huawei and Lenovo can stick around longer, or whether they will eventually find themselves in the same positions as Nokia, BlackBerry and HTC — all out of the top five rankings now partly because it eventually became unsustainable to play in the smartphone game without scale.

In any case, although in times past it seemed that the route to being a worldwide phone leader was to have a strategy of offering devices across a range of price points and feature sets, today that’s not as clear.

Over 70% of the handsets Samsung’s shipping right now are smartphones. And Apple, the number-three player in mobile sales overall, is a smartphone-only vendor. Meanwhile, Nokia’s smartphone share these days is so small that Strategy Analytics doesn’t break it out, meaning that its number-two position among mobile phone makers is based largely on its power at the lower end of the market.

However, it turns out the strategy of not having a killer smartphone lineup not only is not lucrative but eventually self-destructive.

Nokia’s global mobile phone shipments fell 25% between 2012 and 2013, from 335.6 million units to 252.4 million units. “Nokia faced tough competition from Samsung in developing markets like India, while LG and others ramped up the pressure in developed regions such as Western Europe,” writes Mawston. “Nokia’s Windows Phones have been performing relatively well, but this was not enough to offset sluggish demand for its Asha models and other feature phones during the course of the year.”

As Strategy Analytics points out, one route for smaller, national players to survive longer term is to continue to grow internationally. Huawei, it notes, is expanding in Europe; LG’s Optimus range “is proving popular in Latin America”; Lenovo’s Android models are selling at competitive price-points across China. “Samsung and Apple will need to fight hard to hold off these and other hungry challengers during 2014,” notes Sui.

This article was first seen on Techcruch.