Roughly 1000 transactions were made with Apple. Some Bank of America customers have been double-charged for purchases made with Apple Pay, the payment system Apple launched on Monday.

Roughly 1,000 transactions made with Apple Pay were logged twice in customer accounts, said Tara Burke, a spokeswoman with Bank of America, which is one of the largest U.S. banks and was an Apple Pay launch partner.

“We apologize for the inconvenience and are correcting the problem,” said Burke.

The duplicate transactions should be removed by the end of Wednesday.

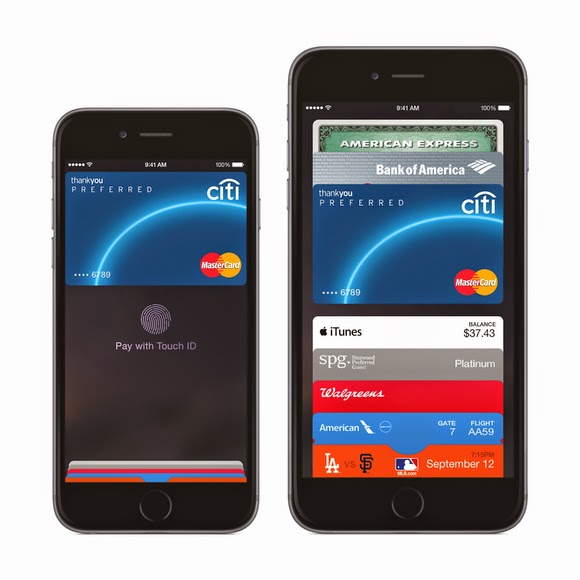

Apple Pay utilizes a secure chip inside Apple’s new iPhone 6 that enables the phone to emulate an NFC (near field communications) payment card. When the Apple Pay app is loaded with a customer’s credit or debit card, payments can be made at NFC terminals by bringing the phone close to the terminal.

Roughly 1000 Transactions. The system is being positioned as easier and more secure than current payment cards because the card number is not passed to the retailer’s terminal. Instead, a substitute number called a token is offered to the merchant, which sends it on to the card issuer for approval.

The token can only be used once, so if it’s stolen it should prove useless to cyberattackers. It’s tied to the actual card number deeper in the financial services network, further away from the retailer terminals that have been the target of so much hacking recently.

Apple Pay is compatible with existing NFC payment terminals, which can be found in around 200,000 shops and taxis across the U.S.

Originally posted on PC World